Visualizing the $6T Unicorn Backlog: Why Private Market Exits Are Frozen in 2025

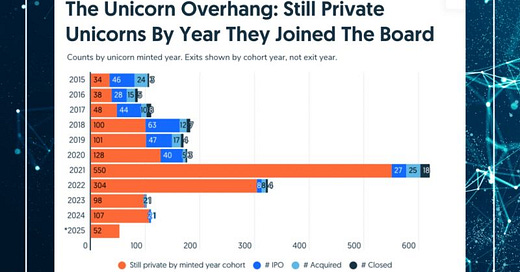

Remember when unicorns were rare? Well, fast-forward to 2025 and there are nearly 1,600 unicorns, valued at almost $6T. Yet the majority are stuck in a holding pattern with big valuations, and little liquidity.

2021 broke the system, as new unicorn creation tripled in one year. But exits haven’t kept up. Over 60% of unicorns haven’t raised at a disclosed valuation in 3+ years. The result is a $6T backlog of private giants with VCs holding markdowns behind the scenes and searching for the elusive exit ramp.

Who’s still waiting:

🔹OG unicorns

🔹The 2021-2022 “hypergrowth” cohort, now stuck in valuation limbo

🔹The AI wave of 2023–2025

Exits today? Scarce. IPO markets? Tepid. And M&A? Slow.

The question isn't if this backlog clears, but how. Will AI fuel the next liquidity wave? Or do we face a drawn-out period of soft landings, markdowns, and quiet closures?

Check out this Crunchbase article for more on this pattern - https://news.crunchbase.com/startups/decade-private-market-unicorn-backlog/